Transforming Business Banking: A Human-Centred Digital Journey

Led CIBC's transformation of business banking onboarding from paper-heavy to digital-first, launching just before COVID-19. The solution reduced in-branch meetings to self-service experiences, enabled async approvals, and set new industry standards for digital business banking.

Turn a time-intensive, paper-based process into an intuitive digital experience that would serve businesses of all sizes.

Timeline: April 2019 - January 2021

Role: Senior UX Designer leading digital transformation

Impact: Enabling seamless business onboarding continuity while addressing the challenges of digital transformation and Covid 19.

TL;DR: Led the transformation of CIBC's business banking onboarding from a paper-heavy, in-branch process to a flexible digital platform. Key wins:

- Reduced onboarding from hours of in-branch meetings to an online self-service experience

- Enabled asynchronous multi-stakeholder approvals

- Launched just before COVID-19, ensuring business continuity

- Decreased enrolment delays by 90% through smart validation and tracking

- Set new industry standard for digital business banking

The Human Challenge

From a banking customer POV, every business has its own story. Some are small startups taking their first steps, others are established enterprises managing complex operations.

But, what united them was a common frustration: opening a business account meant coordinating multiple stakeholders for lengthy in-branch meetings, wrestling with paper documents, and navigating a rigid, one-size-fits-all process. An existing process that wasn't just inefficient — it was affecting real people:

- Business owners losing valuable time coordinating multiple signatories

- Branch staff overwhelmed with paperwork and support tickets

- Support teams constantly chasing missing signatures

- Businesses unable to access banking services when they needed them most

The Collaboration Behind the Transformation

The project had multiple stakeholders from across CIBC; from the front line staff, through the customer application(s) processing / forms team, and into the Banking Services Support and additional implementation back office departments.

Vergel was brought in as a core member to validate the RFP, scope the features and collaborate on the user flows for a multi-stakeholder, multi-step account open process and capture innovation opportunities.

With his deeper understanding of CIBC products and processes, the CIBC's Commercial Banking division approached Vergel to help build a new Digital Business Banking hub. But first, onboarding! His experience in large systems made him an amazing asset from the personas, through business tasks, to measurements of success.

Everything about this project hinged on "What if's":

- What if the business has multiple signing authorities

- What if the business doesn't fit the ideal business banking client

- What if there are secondary questions and products that are not part of the onboarding experience

Together, the team rallied around a key insight and a simple question:

"What if we could let each stakeholder contribute on their own terms?"

Building the Foundation: Key UX Activities

To transform this vision into reality, Vergel lead the team implemented a comprehensive UX strategy across three key phases:

Discovery & Research Activities

- Conducted in-depth stakeholder interviews with branch staff, back-office teams, and business banking specialists

- Facilitated customer interviews and surveys to understand pain points and opportunities

- Synthesized research findings into actionable UX strategies during intensive sprint activities

- Mapped existing processes and identified optimization opportunities

Design & Documentation Artifacts

- Created detailed user flows and journey maps

- Developed business analysis documentation and QA success criteria

- Produced iterative wireframes and high-fidelity mockups

- Built interactive prototypes for stakeholder validation

- Established technical UX documentation standards distributed via Sketch App

Implementation Support Activities

Throughout the engagement, the team was provided with...

- UX guidance across development sprints

- Detailed specifications for offshore development team

- Regular conducted design reviews and iterations with the Product Owner and Development teams

- Maintained living documentation for cross-team alignment

As the project team navigated those early research / planning sessions, a clear vision emerged. Transforming business banking onboarding from a rigid, paper-based system into something more dynamic and user-centric required new business intelligence, and cross team support. Enabling the project team to introduce natural "gates" in moving the banking client forward, and enabled them to include CTA activities to recapture errant applications.

This feature also helped to reduce the number of abandoned applications by including a finality statement for applications over a certain enrollment age. Enabling a systematic approach that ensured that every aspect of the user experience was considered, documented, and validated to ensure a successful engagement.

The Breakthrough

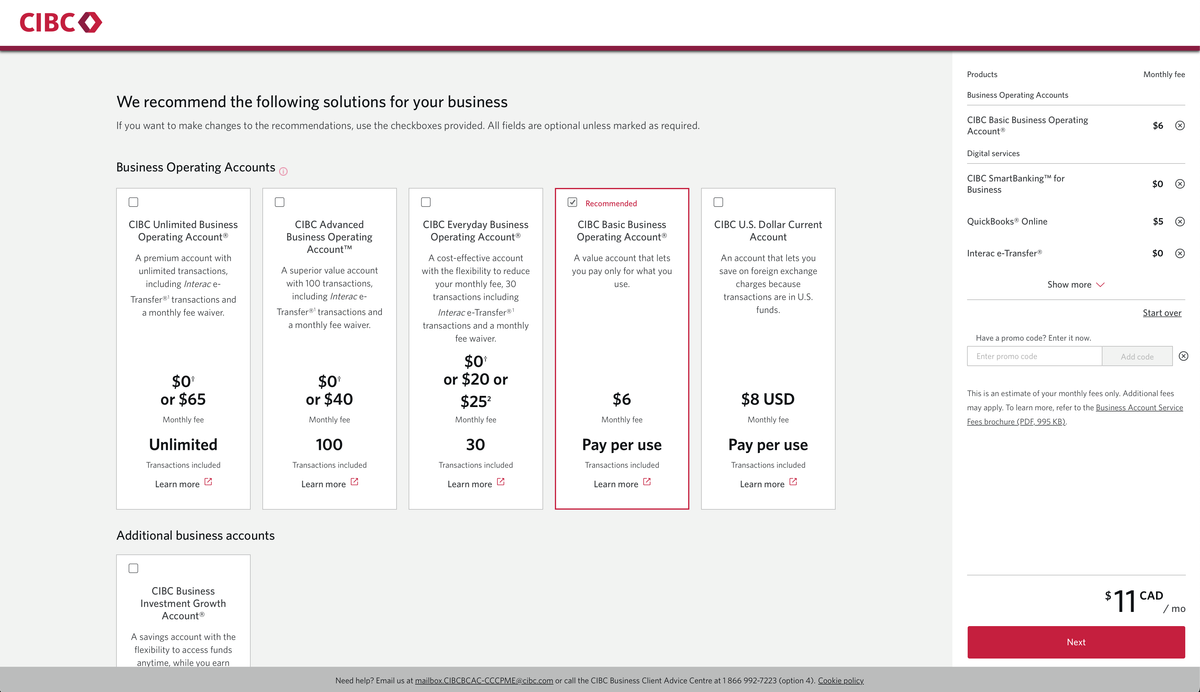

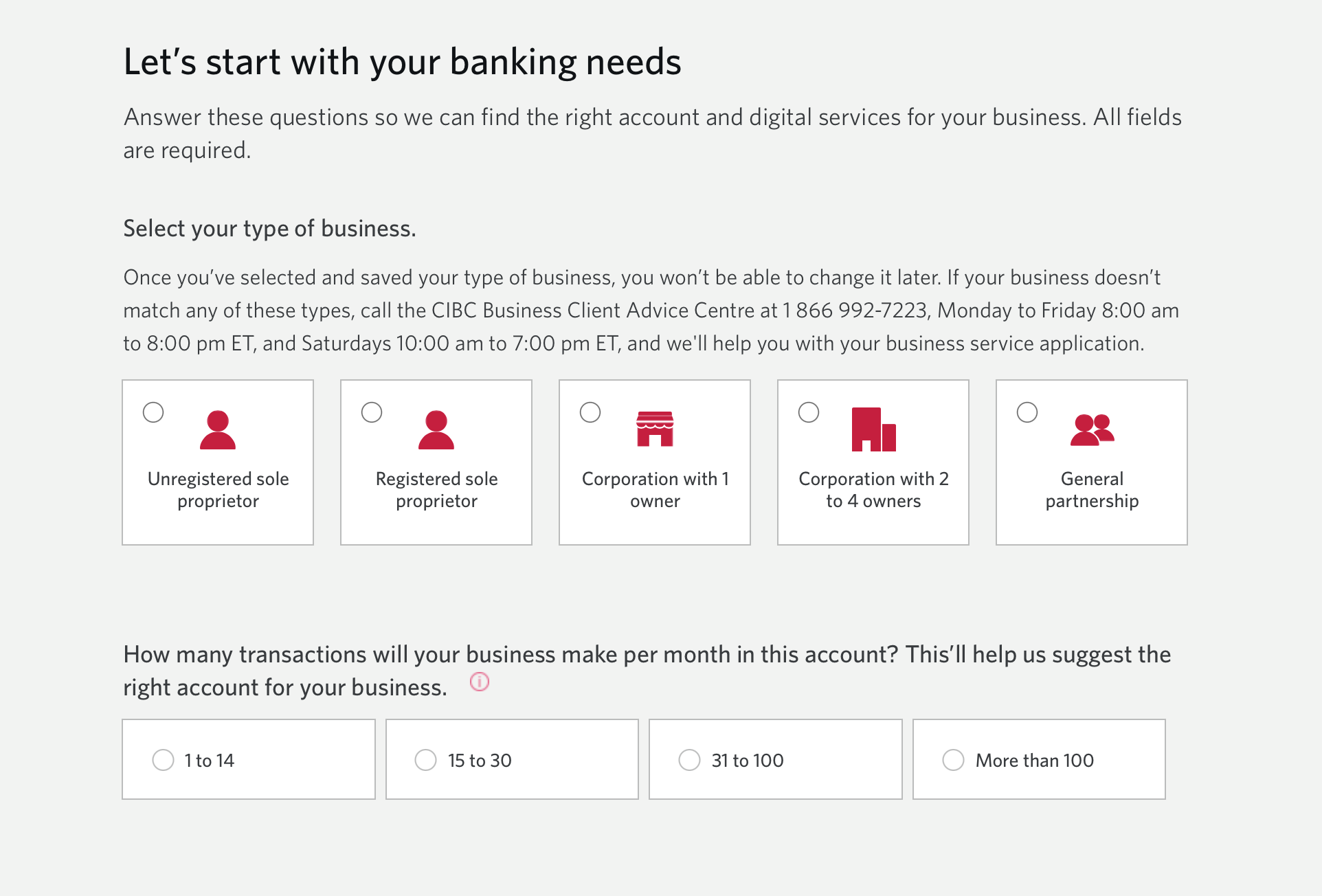

The solution, an asynchronous, à la carte digital experience that:

- Allowed business representatives to complete their portions independently

- Offered customizable service bundles based on business needs

- Implemented smart validation to ensure complete documentation

- Provided clear status tracking for all stakeholders

Technical Innovation with Human Impact

The solution we crafted went beyond just moving forms online. We built:

1. A Smart Digital Portal - Unique access for each signing authority- Real-time status tracking- Automated notifications for pending actions- Mobile-friendly interface for on-the-go access

2. Intelligent Service Selection - Customizable product bundles- Clear pricing comparisons- Smart recommendations based on business profiles- Flexible, step-by-step guided process

3. Streamlined Document Management - Automatic contract generation- Digital signature workflow- Secure document storage- Built-in validation checks

The Transformation

The timing proved crucial. As COVID-19 restrictions began, CIBC was uniquely positioned to continue serving business customers when in-person meetings became impossible. The impact was immediate and lasting.

Finding Clarity in Complexity

To help identify process optimization opportunities, Vergel led an intensive two-week design sprint, and brought together everyone who enabled, or supported the business banking client throughout their enrolment journey. As part of the core phase of the project, spanning across multiple development teams, we found a common solution set and set about it utilizing an agile sprint methodology that included a 1 week cadence.

Mid sprint checklists were also created, SLAs were ratified, and customer onboarding artifacts were prioritized over everything else. This collaborative effort revealed a crucial insight: the solution wasn't just about digitizing papers; it was about reimagining the processes and how the various teams within the bank could interact together to support the customer.

Immediate Benefits

- Onboarding time reduced from a series of 1-2 hour sessions with branch staff to an online a-la-carte selection tool (with a save and resume feature) available when the business team was available rather than ONLY during banking hours

- Enhanced tracking of application state, document preparation and support tickets resulting in fewer issues of missing documentation, branch/back-office staff based enrolment delays reduced to under 10%

- SURPRISE BONUS <– Business continuity maintained during COVID lockdowns

- Not immediately available at the time of the engagement as a formal report, colloquially customer satisfaction was up (via user interviews) but reported scores were not available

Long-term Value

- Now considered a leading product within CIBC, the enrollment application set a new industry standard for digital banking

- Future team allocations were projected to be reduced based on improved operational efficiency

- Enabling digital account opens reduced the small business owner business costs for in-person account open activities

- Established CIBC as a digital banking leader for small business owners

Key Insights

1. Human-Centred Innovation

- Digital transformation succeeds when it solves real human problems

- Flexibility and personalization are key to serving diverse business needs

- Clear communication reduces support needs and builds trust

2. **Future-Ready Solutions**

- Digital-first approaches are now essential, not optional

- Asynchronous processes better serve modern business needs

- Human connection remains vital, even in digital experiences

The Ripple Effect

This transformation went beyond just improving a process—it changed how CIBC interacts with businesses. The project's success led to:

- Integration into departmental strategic planning

- New standards for digital service delivery

- Enhanced competitive positioning in business banking

- Improved customer relationships through digital innovation

Looking Forward

The future of business banking isn't just digital — it's human. This project proved that by understanding and addressing human needs, we can create digital solutions that don't just work better—they work for everyone.